mississippi state income tax rate 2020

5 10000 Source. The most significant are its income and sales taxes.

Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets.

. The Mississippi state government collects several types of taxes. All other income tax returns P. Detailed Mississippi state income.

The Mississippi tax rate and tax brackets are unchanged from last year. 0 on the first 3000 of taxable income. Six statesAlaska Illinois Iowa Minnesota New Jersey and Pennsylvanialevy top marginal corporate income tax rates of 9 percent or higher.

Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Tax Year 2020 First 3000 0 and the next 2000 3 First 4000 0 and the next 1000 3 Tax Year 2022 First 5000 0 250 per 1000 of capital in excess of 100000 Tax Year 2019 225 per 1000 of capital in excess of 100000 Tax Year 2020 200 per 1000 of capital in excess of 100000 Tax Year 2021. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200.

The personal income tax which has a top rate of 5 is slightly lower than the national average for state income taxes. For those subject to the middle rate schedule the top rate has dropped from 60 to 59 percent. Title 27 Chapter 8 Mississippi Code Annotated 27-8-1 Corporate Franchise Tax Laws.

Below are forms for prior Tax Years starting with 2020. 3 4000. 5 10000.

Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at. Rates range from 25 percent in North Carolina to 12 percent in Iowa. The Mississippi Department of Revenue is responsible for publishing.

Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Ten statesArizona Colorado Florida Kentucky Mississippi Missouri North Carolina North.

4 5000. Find your gross income. Our calculator has been specially developed.

3 3000. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202122. Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 S Corporation Income Tax Laws.

Mississippis 3 Percent Income Tax Rate Will Phase Out by 2022. Read the Mississippi income tax tables for Married Filing Jointly filers published inside the Form 80-105 Instructions booklet for more information. Mississippi has a graduated income tax rate and is computed as follows.

Discover Helpful Information and Resources on Taxes From AARP. 3 on the next 2000 of taxable income. Get A Jumpstart On Your Taxes.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. 4 on the next 5000 of taxable income.

Corporate Income Tax Returns 2020. 4 5000. Box 23058 Jackson MS 39225-3058.

Details on how to only prepare and print a Mississippi 2021 Tax Return. Ad Compare Your 2022 Tax Bracket vs. Your 2021 Tax Bracket to See Whats Been Adjusted.

Mississippi State Income Tax Forms for Tax Year 2021 Jan. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Mississippis Individual Income Tax Rate Schedules.

If you are receiving a refund PO. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. Tax Years 2020 2021 and 2022.

Each marginal rate only applies to earnings within the applicable marginal tax bracket. Get Your Max Refund Today. Box 23050 Jackson MS 39225-3050.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Find your income exemptions. Mississippi state income tax rate 2020 Monday February 14 2022 Edit.

Check the 2020 Mississippi state tax rate and the rules to calculate state income tax. Forty-four states levy a corporate income tax. These back taxes forms can not longer be e-Filed.

5 Massachusetts single-rate individual income tax dropped from 505 to 50 percent for tax year 2020 due to the state meeting revenue targets outlined in a tax trigger law that was enacted in 2002. Title 27 Chapter 13 Mississippi Code Annotated 27-13-1. Mississippi Salary Tax Calculator for the Tax Year 202122.

Mississippi Income Tax Forms. Import Your Tax Forms And File For Your Max Refund Today. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

How to Calculate 2020 Mississippi State Income Tax by Using State Income Tax Table. Tax Year 2020 Tax Year 2021 Tax Year 2022. 5 on all taxable income over 10000.

The Mississippi State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Mississippi State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. How Do State And Local Individual Income Taxes Work Tax Policy Center Mississippi Tax Rate H R Block Income Tax Rate In Italy 2020 Guide For Foreigners Accounting Bolla. Find your pretax deductions including 401K flexible account contributions.

However the statewide sales tax of 7 is slightly above the national average.

How Do State And Local Individual Income Taxes Work Tax Policy Center

There Are 9 Us States With No Income Tax But 2 Of Them Still Tax Investment Earnings Business Insider India

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

State Income Tax Rates Highest Lowest 2021 Changes

How Do State And Local Individual Income Taxes Work Tax Policy Center

Low Tax States Are Often High Tax For The Poor Itep

Pennsylvania Income Tax Rate And Brackets 2019

How Is Tax Liability Calculated Common Tax Questions Answered

A Complete Guide To Filing Taxes As A Photographer Income Tax Return Income Tax Filing Taxes

How High Are Capital Gains Taxes In Your State Tax Foundation

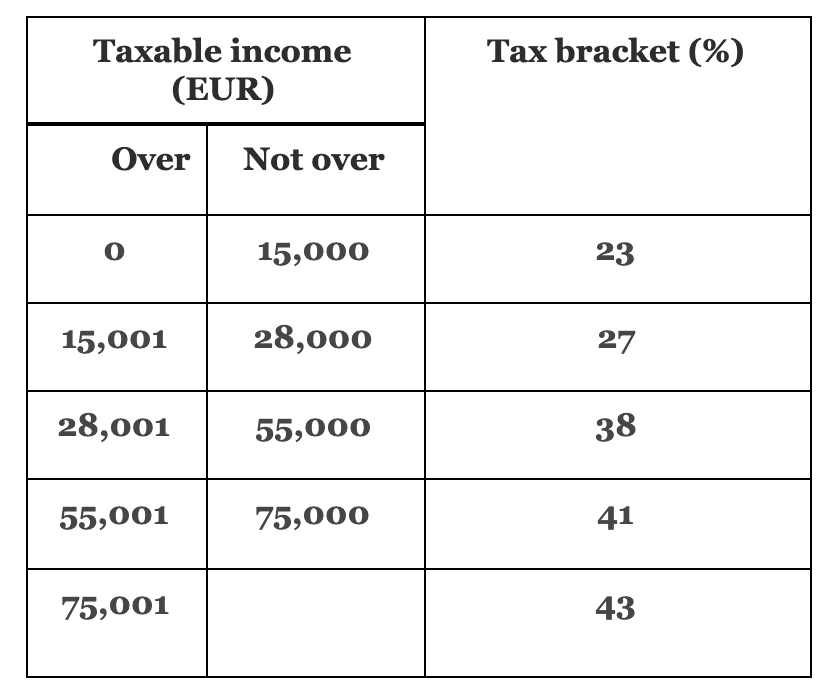

Income Tax Rate In Italy 2020 Guide For Foreigners Accounting Bolla

States With No Income Tax H R Block

Mississippi Tax Rate H R Block

Illinois Income Tax Rate And Brackets 2019

How Is Tax Liability Calculated Common Tax Questions Answered

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)